Chainlink Price Gains Momentum as Whales Accumulate

Coinpedia

2025-08-20 20:12:21

Recently, in August, the Chainlink price has shown remarkable strength, which is mainly driven by surging whale activity, rising adoption, and several positive on-chain indicators.

Currently, the momentum is building after crossing $26 for the first time in the past seven months, and LINK price looks well-positioned to extend gains on the upside.

Investors and traders are aggressively eyeing whether the asset can push toward the $30 mark. Keep reading to know more.

Chainlink Reserve Initiative Boosts Investor Confidence

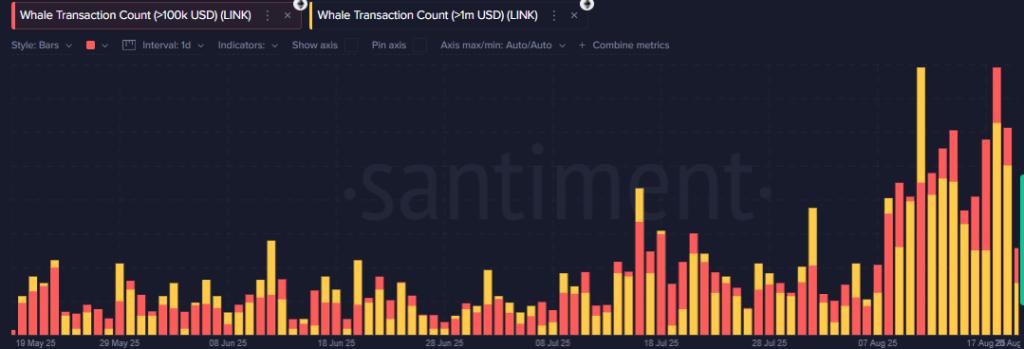

Most recent data from the Santiment platform reveals that Whale activity has been a defining factor in August.

As data highlights transactions that were over $100K and $1 million have risen sharply this month, partly due to the Chainlink Reserve initiative, which has boosted confidence in long-term utility.

Combined with the earlier success of CCIP, these developments have set a strong base for the Chainlink price.

Even the remarkable growth has been evident in the MVRV 30-day ratio, which reveals that it has flipped from losses to profit, rising from -6.765% to 18% in August. This reflects improving profitability among the last 30-day holders.

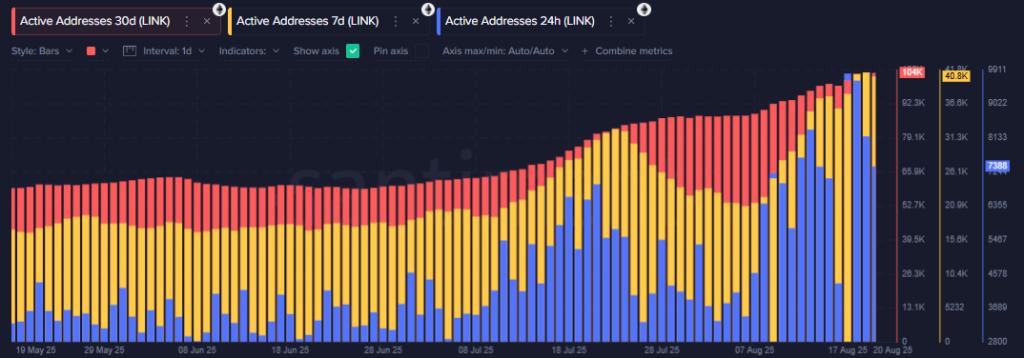

Moreover, active addresses have also been the proof of optimism as it reached a three-month peak, signaling stronger adoption. LINK price chart trends confirm this bullish bias, strengthening the case for a broader Chainlink price forecast.

LINK Price Benefits From Altcoin Season Signals

Since it’s evident that on the daily chart, Chainlink has recently surged above $26, which is its highest level in seven months. This was made possible as on-chain growth continues to accelerate.

Santiment insights on August 19th mentioned that nearly 9,813 wallets were active in transfers, and 9,625 new wallets were created in just two days. This data is the highest in 2025 per the platform’s analyst “brianq”. These metrics point to rising adoption and support an optimistic Chainlink price prediction.

Similarly, in the bullish context, he also added that the Retail sentiment has flipped bearish as Bitcoin dipped below $113K, but historically, such fear provides opportunities for patient smart money investors.

Additionally, on the LINK price chart, the breakout from a suggests ongoing momentum. With the altcoin season index at 51, altcoins like Chainlink may benefit further from renewed risk appetite.

Institutional Interest and Key Levels to Watch

Technically, Chainlink is holding above a fixed range volume profile level, considered a key institutional footprint zone. This has become a “make-or-break” point that could determine whether LINK retests $30 in order to push toward its 2021 peak near $52.

With RSI cooling to 64, LINK price USD still has room for another strong spike, supported by institutional flows.

最新快讯

ChainCatcher

2025-08-27 03:17:51

ChainCatcher

2025-08-27 03:05:43

ChainCatcher

2025-08-27 02:56:20

ChainCatcher

2025-08-27 02:54:32

ChainCatcher

2025-08-27 02:48:38