Sharplink Gaming’s expanded $6B share offering could buy 1% of ETH

Cointelegraph

2025-07-18 14:01:09

Joseph Lubin-backed SharpLink Gaming has drastically increased the equity it intends to sell to scoop up more Ether — and has added $515 million of Ether to its treasury in just the last nine days.

In a prospectus supplement filed with the US Securities and Exchange Commission on Thursday, SharpLink said it has increased the amount of common stock it can sell by an extra $5 billion, up from a billion under its initial May 30 filing.

Similar to its prior prospectus, SharpLink said it will use the majority of the proceeds to acquire Ether .

“We intend to contribute substantially all of the cash proceeds that we receive to acquire Ether [...] We also intend to use the proceeds from this offering for working capital needs, general corporate purposes, operating expenses and core affiliate marketing operations.”

If SharpLink were to use $6 billion to buy ETH for its treasury today, it would hold nearly 1.38% of ETH’s circulating supply.

ETH acquisition continues

On Monday, SharpLink became the largest corporate holder of ETH, and in a more recent X post, SharpLink hinted that it intends to hold 1 million ETH for its treasury.

As of Tuesday, the company held more than 280,000 ETH in its reserve, with approximately 99.7% of the asset being staked.

SharpLink has generated 415 ETH, worth $1.49 million, as a staking reward between June 2 and July 15.

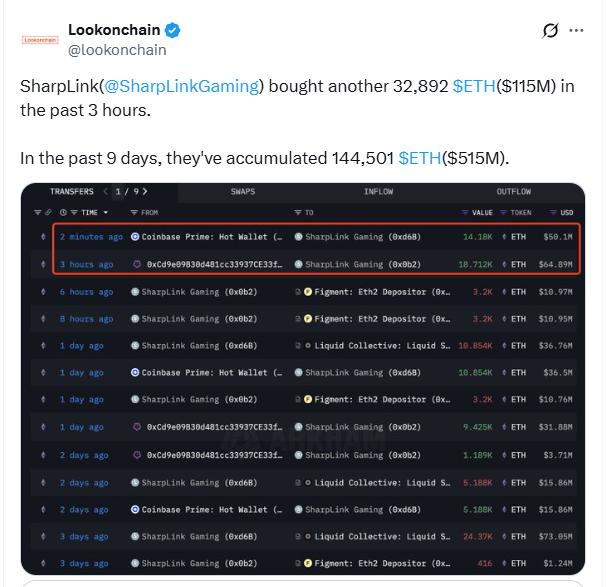

Following the regulatory filing of its increased share offering, SharpLink bought another 32,892 ETH, worth $115 million.

The company has now purchased $515 million worth of ETH in the past nine days, according to Lookonchain.

Galaxy Research noted that SharpLink surpassing the Ethereum Foundation’s total ETH holding acts as a positive catalyst for the ecosystem.

Stock dips

Sharplink Gaming (SBET) stock ended Thursday’s trading session at $36.40, a decrease of 2.62%. The stock further fell after the bell and ended the after-hours trading session with a cut of 4.95% at $34.60, according to Google Finance.

SBET is up 350% year-to-date; however, the stock is down 54% from its May 29 high of $79.21.

In the March quarter, SharpLink saw its revenue decline 24% year-on-year, while its net profit margin decreased by 110% during the quarter.

The company is expected to announce its next quarterly results on Aug. 13, according to Nasdaq.

最新快讯

ChainCatcher

2025-07-22 00:08:01

ChainCatcher

2025-07-22 00:02:28

ChainCatcher

2025-07-22 00:00:21

ChainCatcher

2025-07-21 23:49:13

ChainCatcher

2025-07-21 23:48:08